Investing 101: Building Wealth for the Long Term

Let’s talk about Investing 101: Building Wealth.

Welcome to the final post in our Money Month series! Throughout this series, we’ve explored various topics to help you gain financial awareness and empower yourself for a brighter financial future.

Today, we explore investing—a topic that often seems intimidating and overwhelming. With so many options, unfamiliar terminology, and the ever-present element of risk, it’s no wonder investing leaves many people perplexed. But fear not! I’m here to offer some practical steps and lighthearted guidance to get you started on your investing journey.

Before we begin, let me preface this by saying that I am not an expert in this field. I don’t possess fancy titles like Chartered Financial Analyst or Certified Financial Planner. I’m a Financial Coach sharing my personal experience and opinions. So, while I’ll provide you with some insights, please consult with a professional, and do your own research.

Now, let’s embark on our investing adventure!

Why Investing is a Must for Building Wealth

Most of us understand the essential role saving plays in personal finance. Sure, having savings is fantastic—kudos to you for stashing away those hard-earned dollars! But here’s the thing: saving alone won’t cut it if you want to build significant wealth for the long term. Investing is the secret sauce that supercharges your financial growth. It allows your money to work harder and smarter, generating potential returns that can outpace inflation and help you achieve your financial goals faster.

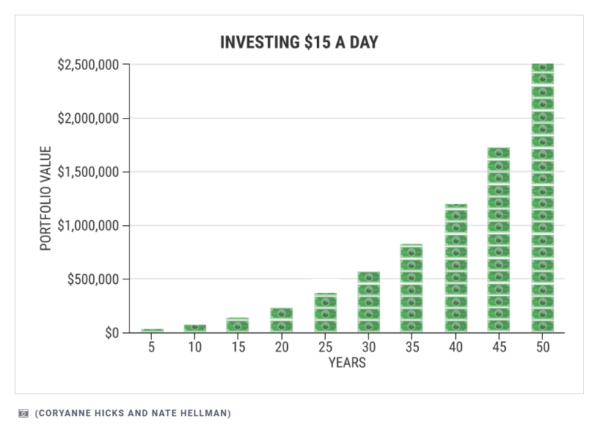

And some say investing is the easiest way to achieve millionaire status. Consider the chart below. Notice the impact of investing just $15 per day consistently at a 7% rate of return. The outcomes are truly remarkable!

Consider this: by investing just $15 per day in the stock market, an investor could witness her portfolio grow to over $1.2 million within 40 years. And if she continues to invest $15 per day for 50 years, her accumulated wealth could reach a staggering sum of nearly $2.5 million.

Consider this: by investing just $15 per day in the stock market, an investor could witness her portfolio grow to over $1.2 million within 40 years. And if she continues to invest $15 per day for 50 years, her accumulated wealth could reach a staggering sum of nearly $2.5 million.

The market is best for those who are faithful for the long haul. So, buckle up and get ready to explore Investing 101!

When to Start Investing

Now that you’re convinced of the importance of investing, you might wonder when the best time to start is. The answer? Right now! Time is your greatest ally in the world of investing. The sooner you start, the longer your money has to grow through the magic of compounding.

However, there are a few valid reasons you may want to delay investing:

- You haven’t set clear financial goals: It’s essential to have a clear vision of your financial goals before investing. Are you saving for retirement, a down payment on a house, or your child’s education? Understanding your goals and their timeframes will help you determine the appropriate investment strategies and risk tolerance.

- You are heavily indebted: If you have high-interest debts, such as credit card debt or personal loans, it may be wise to focus on paying off those debts first. That will help you reduce the financial burden and create a solid foundation for investing. Click here for more on this topic.

- You lack an emergency fund: Before diving into investments, it’s crucial to have a safety net in the form of an emergency fund. Aim to save three to six months of living expenses in a readily accessible account. Doing so provides a financial cushion and peace of mind in case of unexpected expenses or job loss.

Would waiting make you feel like you’re missing the boat? Don’t fret—there’s always an opportunity to start and make progress. It’s never too late to begin your investing journey.

Embark on your investing journey with a curious mind, a patient heart, and a steadfast commitment to learning. Like a seed planted with care, your investments will grow and flourish, nurturing your financial future.

Remember, everyone’s financial situation is unique. And it’s crucial to make informed decisions based on your specific circumstances. Investing is a long-term commitment, so take the time to evaluate your situation and make decisions that align with your financial goals and priorities.

Consulting with a financial advisor or planner can provide personalized guidance tailored to your needs.

Investing for Beginners (The A, B, Cs)

If you’re new to investing, don’t worry—I’ve got your back. Here are four easy ways to dip your toe into the investing waters:

A – Ask for Advice and Educate Yourself: Find a knowledgeable Financial Advisor who can give sound advice. And educate yourself by reading books, following reputable financial websites, and taking advantage of online resources to enhance your investment knowledge. The more you understand, the better equipped you’ll be to make informed investment decisions.

B – Begin with Employer-Sponsored Retirement Accounts: Take advantage of retirement plans like 401(k)s or IRAs offered by your employer. These plans often provide tax advantages and a great starting point for your investment journey.

C – Consider Robo-Advisors: Robo-advisors are online platforms that use algorithms to manage and optimize your investment portfolio. They offer automated, low-cost investment management services, making investing more accessible and convenient for beginners.

Key Questions to Ask Your Financial Advisor

When seeking professional advice, asking the right questions is crucial. Here are a few inquiries to help you make the most of your conversation with a financial advisor:

- What is your investment philosophy and approach?

- How do you manage risk in investment portfolios?

- What are the fees and expenses associated with your services?

- Can you provide examples of past client successes or testimonials?

- How often will we review and adjust my investment strategy?

Remember, building wealth through investing is a journey that requires patience, resilience, and a sense of humor. Don’t be too hard on yourself if the market takes a dip or your investments don’t skyrocket overnight. Stay committed to your long-term goals, stay informed, and make adjustments as needed. Please book a complimentary consultation if you need help.

Invest in Your Future

By venturing into the world of investing, you’re taking a significant step toward building wealth for the long term. Embrace the adventure, learn from your experiences, and enjoy the process. Here’s to your success!

(Note: This blog post is for informational purposes only and should not be considered financial advice. Please consult with a qualified professional before making any investment decisions.)

Lisa L. Baker is a professional life coach, career strategist, and keynote speaker. Lisa is the founder of Ascentim – a Maryland-based coaching practice that utilizes a unique G.R.O.W. process to help clients gain clarity, realize new possibilities, overcome obstacles, and win at life. Lisa shows high-performing professionals how to Level Up and Live the Life of Their Dreams.